The 9-Minute Rule for Custom Private Equity Asset Managers

Wiki Article

The Only Guide for Custom Private Equity Asset Managers

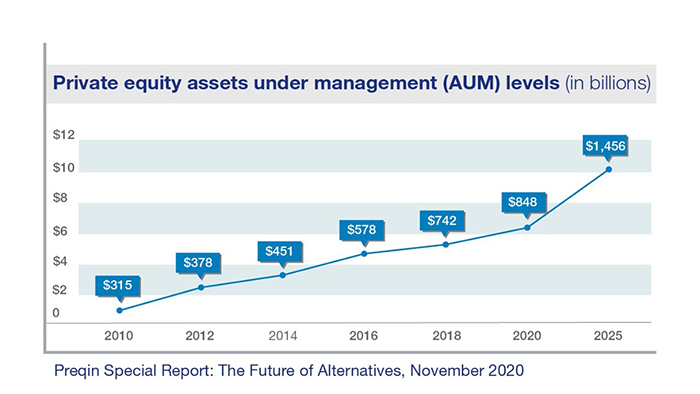

(PE): spending in companies that are not openly traded. About $11 (https://codepen.io/cpequityamtx/pen/VwgqKQX). There may be a couple of points you do not comprehend regarding the market.

Personal equity firms have an array of financial investment choices.

Because the best gravitate towards the larger bargains, the middle market is a considerably underserved market. There are a lot more sellers than there are extremely seasoned and well-positioned money experts with considerable purchaser networks and sources to manage a deal. The returns of personal equity are typically seen after a couple of years.

The Best Guide To Custom Private Equity Asset Managers

Flying listed below the radar of huge multinational companies, many of these small companies usually find more information give higher-quality customer solution and/or niche items and services that are not being provided by the large corporations (https://allmyfaves.com/cpequityamtx?tab=Custom%20Private%20Equity%20Asset%20Managers). Such benefits attract the interest of personal equity firms, as they possess the understandings and savvy to exploit such possibilities and take the business to the next degree

Most managers at portfolio business are offered equity and perk settlement frameworks that award them for hitting their economic targets. Private equity possibilities are commonly out of reach for individuals who can not spend millions of bucks, but they should not be.

There are guidelines, such as restrictions on the aggregate amount of money and on the number of non-accredited capitalists (Private Asset Managers in Texas).

The smart Trick of Custom Private Equity Asset Managers That Nobody is Discussing

One more negative aspect is the lack of liquidity; once in an exclusive equity transaction, it is not very easy to get out of or market. With funds under administration already in the trillions, exclusive equity companies have ended up being eye-catching financial investment automobiles for well-off people and institutions.

Currently that access to exclusive equity is opening up to more private investors, the untapped possibility is coming to be a reality. We'll start with the major arguments for investing in personal equity: Just how and why personal equity returns have actually traditionally been higher than other properties on a number of levels, How including personal equity in a portfolio affects the risk-return profile, by helping to expand versus market and cyclical threat, After that, we will certainly outline some essential factors to consider and risks for personal equity capitalists.

When it pertains to introducing a brand-new possession into a portfolio, the many fundamental factor to consider is the risk-return account of that possession. Historically, personal equity has actually exhibited returns comparable to that of Emerging Market Equities and greater than all other typical asset courses. Its relatively reduced volatility combined with its high returns produces an engaging risk-return profile.

The 9-Second Trick For Custom Private Equity Asset Managers

Private equity fund quartiles have the widest range of returns throughout all alternate asset courses - as you can see below. Method: Internal price of return (IRR) spreads calculated for funds within classic years individually and after that averaged out. Median IRR was computed bytaking the standard of the typical IRR for funds within each vintage year.

The effect of including personal equity into a portfolio is - as always - dependent on the profile itself. A Pantheon research from 2015 suggested that consisting of personal equity in a portfolio of pure public equity can unlock 3.

On the other hand, the most effective personal equity companies have accessibility to an even larger swimming pool of unknown possibilities that do not encounter the same examination, as well as the resources to carry out due diligence on them and identify which are worth buying (Private Equity Platform Investment). Spending at the very beginning means higher danger, yet for the companies that do prosper, the fund benefits from higher returns

What Does Custom Private Equity Asset Managers Do?

Both public and personal equity fund supervisors dedicate to spending a percentage of the fund yet there stays a well-trodden concern with aligning rate of interests for public equity fund management: the 'principal-agent problem'. When a capitalist (the 'principal') hires a public fund supervisor to take control of their funding (as an 'representative') they entrust control to the supervisor while retaining possession of the possessions.

When it comes to exclusive equity, the General Partner doesn't just make a monitoring fee. They also make a portion of the fund's earnings in the form of "bring" (generally 20%). This ensures that the interests of the supervisor are aligned with those of the capitalists. Private equity funds also mitigate an additional form of principal-agent issue.

A public equity investor inevitably wants something - for the administration to enhance the supply price and/or pay returns. The investor has little to no control over the decision. We showed over the amount of exclusive equity strategies - specifically majority acquistions - take control of the running of the firm, making sure that the long-lasting value of the business comes initially, pushing up the roi over the life of the fund.

Report this wiki page